Orange County Investment Seminar Wrap-Up

Last week we put together an informative and fun investment seminar for our friends, colleagues, and past and present Clients. We heard from many of you who wanted to attend but couldn’t, and thought that while you wait for us to schedule our next event we would share some highlights from last week’s class.

We were fortunate to have some amazing speakers in the house with us last week, and we thank them all for joining us:

Ryan Rippy Business Development Manager at The Entrust Group – Leading Provider of Self-Directed IRAs.

Hajir Nejati Area Sales Manager at Bay Equity Home Loans.

Lisa Locke & Trish Rose-Wolf Title Representatives at Western Resources Title

________________

Signs of an Improving Macro-Economic Picture Across the United States and California

(or, Why You Should Invest In Real Estate Today!)

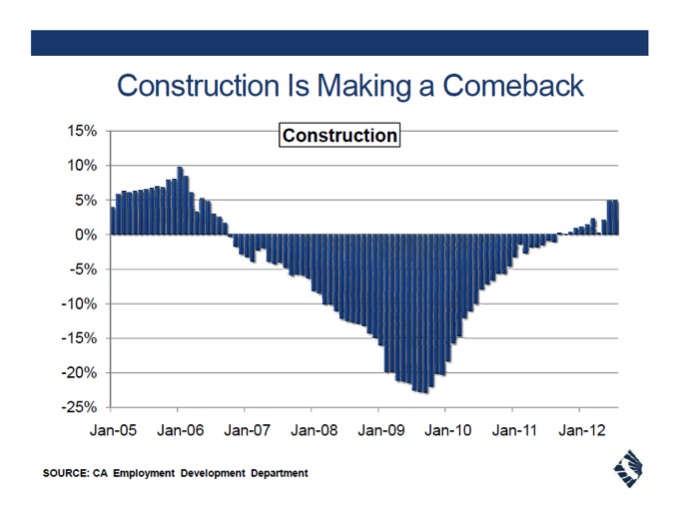

Construction is making a comeback in CA after taking a significant drop. Beginning in 2012, our construction market has seen positive numbers for the first time in years:

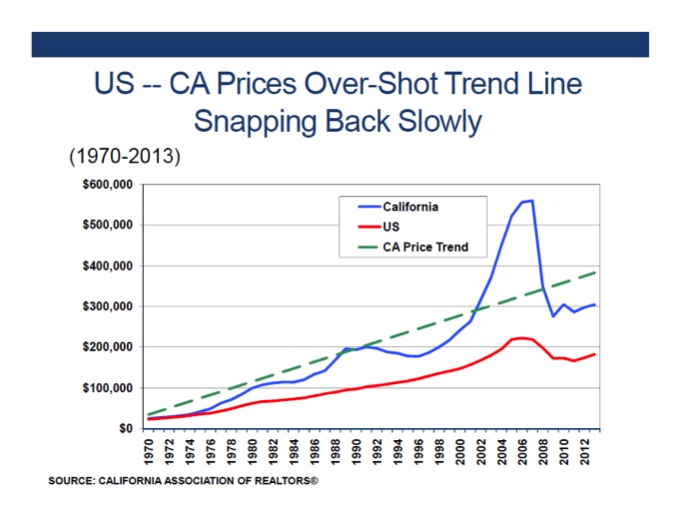

Since 2009, home values in California have finally normalized (relative to the rest of the US) after having shot up dramatically in 2000-2002, and then taking a drastic fall in 2006-2008:

California housing affordability is at it’s highest level in a long time. During the peak of the market, less than 15% of CA residents could afford a home here. Now, we are closer to the national average with over 50% of residents being able to afford the median priced home in California:

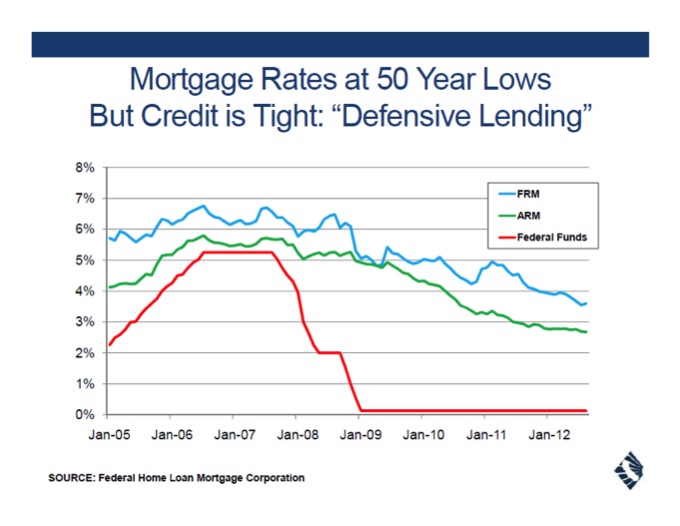

Mortgage interest rates are at 50 year lows, but loans aren’t quite as easy to get as they used to be:

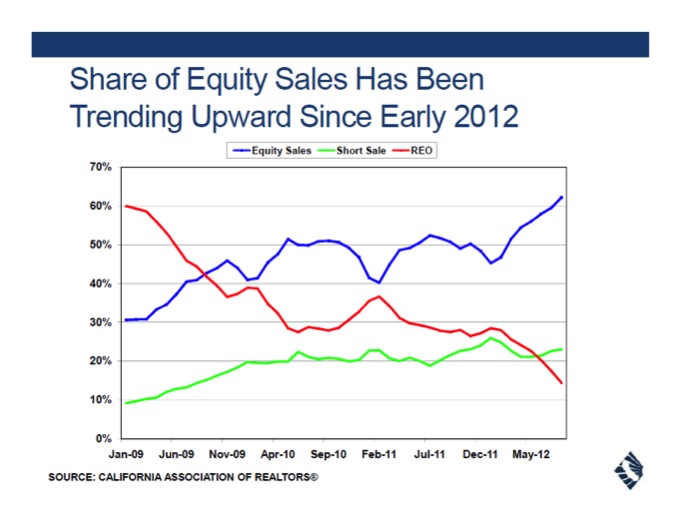

Back in 2009 at the peak of the recession, over 70% of all properties on the market in California were distressed (either short sales or REO – Real Estate/Bank Owned). Today that number only represents about 30% of the market, and equity sales comprise about 70% of the available inventory:

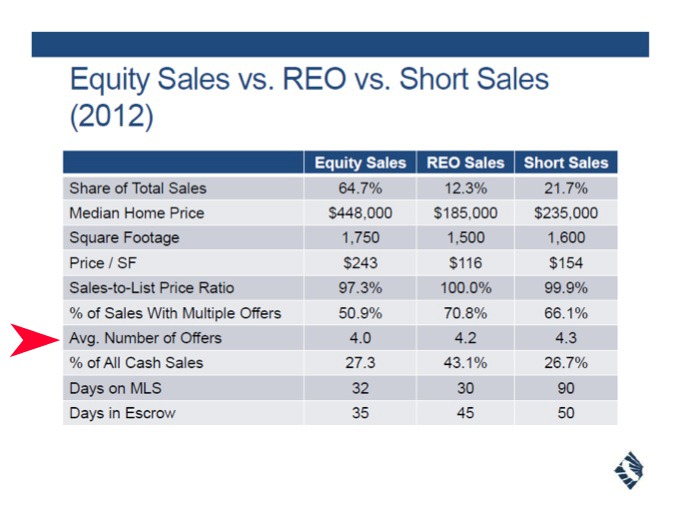

The average property currently on the market in California has more than 4 offers. Properties are selling at or above their list price, and about 1/3 of all transactions have been from cash buyers:

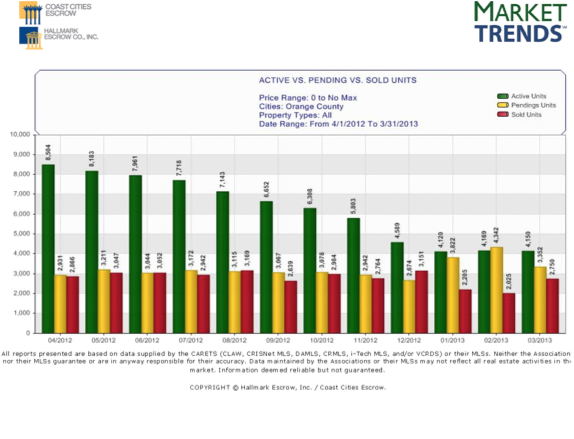

Overall, there is a downward trend of housing inventory (see green) in Orange County, yet, the number of properties in escrow and sold (yellow and red) has been consistent and increasing. This means a big and sustained draw down in homes for sale:

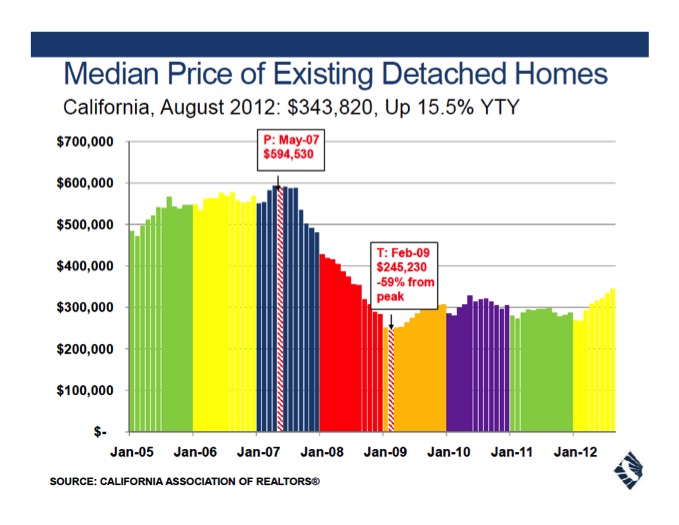

Don’t forget to look at the big picture – this next slide shows the median home price in California at the peak of the market (5/2007) vs. the trough of the market (2/2009). Despite home values having increased significantly over the past 12 months, in the grand scheme of things, homes are still an exceptional value right now:

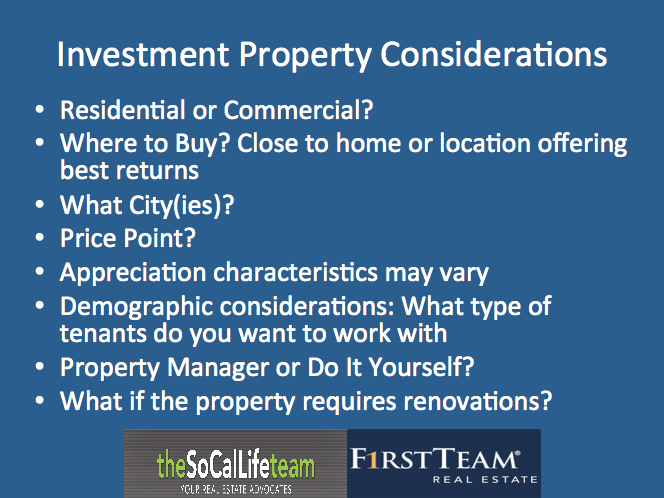

There are several considerations to make with regard to investment properties. Here are a few of the more important ones that we ask our buyers to focus on:

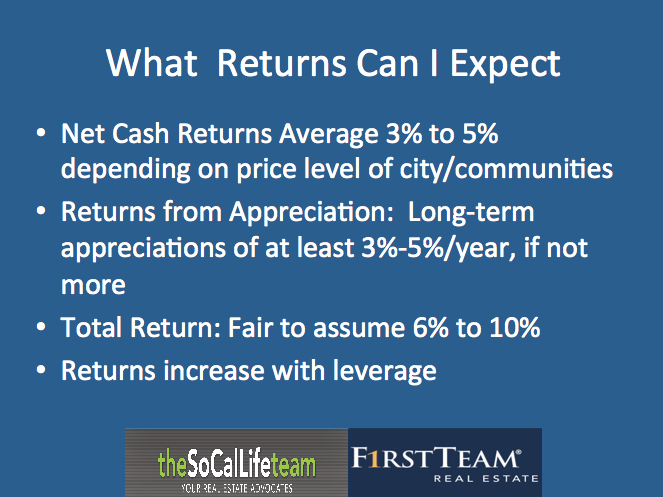

Our last slide is the best one, in our opinion–it’s the reason you buy investment property, right? Here are some examples of the returns you might expect from your property:

We know this post can’t substitute for being at the Investment Seminar, but we hit on some of the more important points that were discussed. As always, please don’t hesitate to contact us if you have any other questions. We hope to see you at our next seminar!