Why Buying is Better than Renting

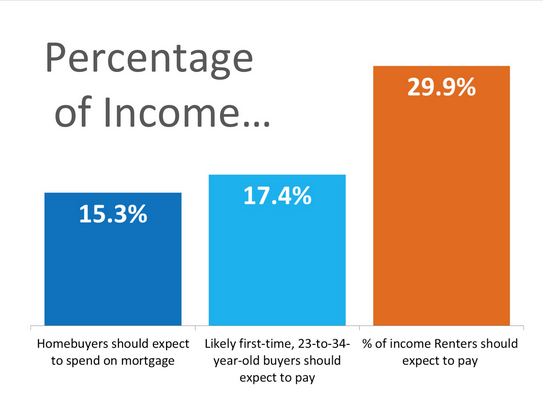

The KCM Crew gives you a couple of reasons it’s wise to buy right now instead of renting. 1. Homebuyers spend an average of 15.3-17.4% of their income on their mortgage, while renters pay 29.9%. 2. Buying a home is 30.8% more affordable than renting compared to statistics from 1985-1999.